The law of large numbers (LLN) is familiar to many. Whenever we draw conclusions from a (hopefully large) set of sample observations, we are implicitly using LLN, which effectively says that our observation from the samples is close enough to the true population.

However, more often than not, we fall victim to the law of small numbers (LSN), precisely because our sample size is not big enough. The “pattern recognition” that VCs enjoy talking about is a textbook example of LSN, yet this myth has not been busted.

When biases get taken as gospels, danger approaches. In this post, I will talk about the lens I take to assess sizes in investment. Size matters, but only for some.

Size: A Necessary Condition

Every investment manager talks about alpha, as they should, because they don’t deserve their jobs if they only deliver beta. However, alpha is by default in limited supply, as when you outperform, others will underperform. Alpha generally comes down to one of the below:

Information: You know what others don’t know

Insights: You know a truth that others don’t agree with

Access: You can access what others can’t access

Inevitably, the source of alpha requires heavy maintenance and has a size limit. It is not uncommon for known great investors to cap their investment size to keep their performance, or for great investors’ performance to deteriorate when the size goes up.

Examples of the former include Ray Dalio capping the All Weather Fund size, Jim Simons restricting access to the flagship Medallion fund, Michael Burry (initially) liquidating his hedge fund post-GFC bets payoff, and Jamie Mai mainly managing his own capital, along with capitals from a handful of investors in his inner circle.

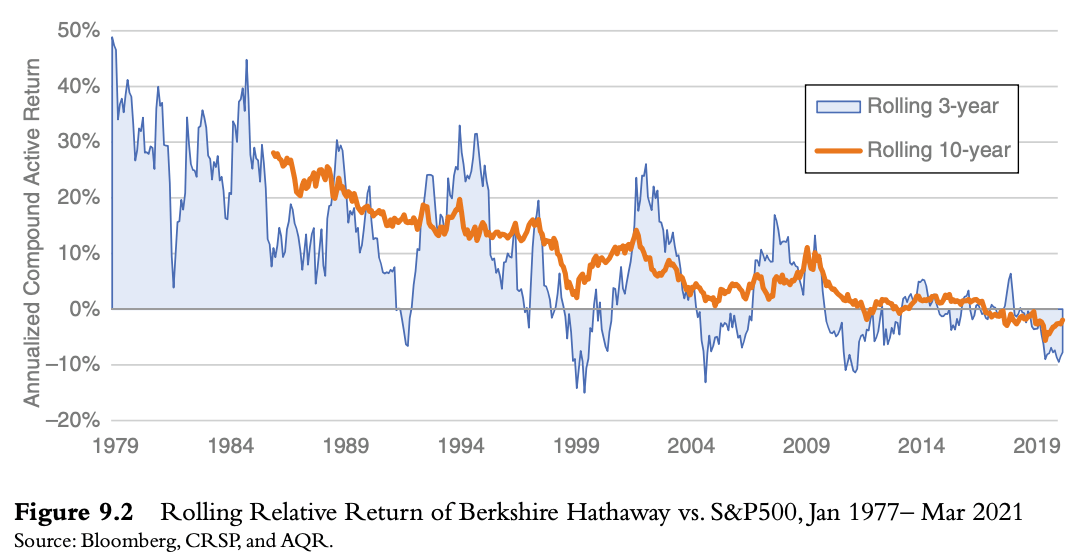

The latter includes the most well-known investor, Warren Buffet. Below is his relative performance over the index over the last few decades.

It is obvious that his scale of outperformance is evaporating as the size of Berkshire Hathaway gets larger. In fact, Warren Buffet himself admitted that size, or the lack of it, is a structural advantage. I think it is still true today, especially for those who are wealthy enough to have access to low cost of funding and knowledgeable enough to know where to look for opportunities that are small enough to be ignored by institutional players (see Outperforming the Market).

The highest rates of return I've ever achieved were in the 1950s. I killed the Dow. You ought to see the numbers. But I was investing peanuts back then. It's a huge structural advantage not to have a lot of money. I think I could make you 50% a year on $1 million. No, I know I could. I guarantee that.

Not to mention that the majority of his outperformance can be attributed to some beta rather than pure alpha, but that is a discussion for another day.

Buffet return breakdown

I think we can all agree that size matters, both theoretically and empirically. This establishes size as a necessary condition for outperformance. When an investment manager is challenged on having too big a size and tries to defend it by throwing a big market size number, chances are, the size is too big and any alpha will be diluted.

Size: Not a Sufficient Condition

If small size is a structural advantage, should people just go to the small funds to find alpha? The answer is yes, but there is more to it.

If we establish that size kills alpha and that small size is necessary for alpha, of course, small funds are the answer. However, small size is not sufficient. If you give $100 to anyone on the street, I bet you don’t expect them to 10x the capital, as you shouldn’t.

What people don’t realise is that, while size kills alpha (outperformance), it also kills negative alpha (underperformance). When size is large enough, you just get index returns (minus management fees).

Size, in a statistical context, corresponds to the range of outcomes you can expect. When size is large, your best-case scenario and worst-case scenario outcomes converge. Whereas when size is small, you can be the winner who takes all, or the sheep who lose everything on virtually investment scams, and everything in between.

When small size is mistaken as a sufficient condition for the desirable outcome, an uninformed decision would be made and this can be costly. In the book "Thinking, Fast and Slow," it documented a case study where the Gates Foundation observed that small schools often appeared at the top of performance lists and inferred that small school size was a key factor in their success. However, they failed to consider that small schools also appeared frequently at the bottom of performance lists. This variability was due to the small sample sizes, which are more prone to extreme outcomes. The experiments to replicate the supposed benefits of small schools in larger schools, by reducing class sizes and student-teacher ratios, did not yield the expected dramatic improvements.

In the context of investment, if you give your money to managers with no skills, small size simply gives you a chance to toss coins, and you get told that the investments you make are ‘highly risky’ in nature, so when they lose money, you should blame yourself, not them. For managers with skills, small size is a one-way rocket ship that has huge upsides and extremely limited downsides. Believe it or not, many truly excellent investors’ number one rule is to not lose money (mostly due to the volatility trap as opposed to risk preference). Putting this in perspective, their investment track record is even more remarkable.

Small size is a structural advantage only to those who can deliver alpha. For people who can’t identify managers who can deliver alpha and have small size funds, you’d be better off investing in a public index fund as the fees are minimum and there is no underperformance by definition. Mistaking small size as a sufficient condition for outperformance is a convenient way to burn your capital.

Incentive Misalignment

In today’s world, the size question comes up more in private funds than public funds, as active management in the public space is drying up as investors become increasingly cost-conscious. Most likely when people invest in the public market, they look to invest in an index fund or a low-cost ETF, than a hedge fund or mutual fund.

Curiously, things in the private market are different - the private fund managers seem to be able to have the cake and eat it too. Empirically, private fund returns don’t have an illiquidity premium attached to them, which means the LPs did not demand any extra returns for locking up their funds for over 10 years. Private funds have more inflows than outflows, despite a shockingly expensive 2/20 fee structure. Private funds prove to smooth out their paper returns but the return smoothing due to illiquidity is actually being perceived as low volatility, so performance pressure on private fund managers isn’t anywhere near their public fund peers.

The combination of those factors creates an incentive misalignment issue for private fund managers. If they are not required to deliver high risk-adjusted returns, not held accountable for performance for a long time, and the management fee alone can be 2% p.a., they will just raise as much as they could. The business of selling money in the private market context is truly lucrative.

If private fund managers have the incentive to raise as much as they could, high multiples won’t be what they optimise for, unfortunately. For small funds, the small size is not a choice, but a reality of them unable to raise a larger fund.

A Framework to Think About Size

How do we approach size then? The return decomposition framework commonly used in quantitative analysis is suitable.

Alpha is bound to be limited in size, so working out its size would be the first step. This is a lot easier said than done. For example, if someone claims the source of alpha is to ‘invest in underrated talent,’ it is really vague and potentially intentionally so. For things that sound vague, questionable, and non-quantifiable, I see them as opinions, not insights, hence no alpha. For true alpha sources like, ‘the implied volatility of dual listed stocks is different,’ size can be derived scientifically.

After alpha, it is almost all beta. That’s the average quality deals you see when a basic amount of due diligence has been performed by the investment manager. Of course, when the manager is known to not perform even the minimal due diligence, you should also expect to lose some money on scams but surely you will get told by the manager that it doesn’t matter. Those deals fall in a return distribution that ranges from 0 to high multiples. You are paying to play the spray and pray game.

If somehow you have to invest in a manager, you have to work out how much alpha this manager can deliver based on the size of the alpha, and how much you are paying for beta. For Buffet, a 4% p.a. in alpha is still decent if you are paying much less than that.

For managers like Soros, where the alpha is negative after accounting for all the beta sources, you will have to consider what you are paying for exactly. If it is a service to keep your capital invested, it might still be valid. For example, people are known to be paying 1-2% p.a. to get financial planners to look after their portfolios, and surely, financial planners have no alpha. If those people will not invest otherwise, they still benefit in the end, despite paying a high fee for the services they receive.

TL;DR - Size matters, but only for some.

Reference

Daniel, Kahneman. Thinking, fast and slow. 2017.

Ilmanen, Antti. Investing amid low expected returns: Making the most when markets offer the least. John Wiley & Sons, 2022.