Uncertainty might be one of the most crucial characteristics of financial markets; its presence means that quantitative modelling will never dominate the market. The precise calculations of scientific methods often give people a false sense of security, and an over-reliance on technology might backfire.

WARNING: Physics Envy May Be Hazardous To Your Wealth! --- Andrew Lo

The 19th century belonged to physics, and WWII pushed physics research to its peak. University physics departments never worried about funding, university positions multiplied, and enthusiastic students flocked to the field. This trend ended in the 1970s, and academia as a career choice collapsed, leaving many at a loss. In 1973, the Middle East oil embargo caused oil prices and interest rates to soar. Gold prices surged past $800 an ounce due to safe-haven demand, while bonds, also considered safe-haven assets, seemed highly risky. Financial markets became extremely volatile, and traditional rules of thumb seemed inapplicable. Modeling based on interest rates and financial asset volatility became crucial, and physicists with a background in dynamic systems were the ideal candidates for this task. Thus, a new profession emerged in the 1970s, called financial engineers, now known as quants.

The birth of quants has always been intertwined with physics. I've even heard of investment strategies based on quantum mechanics. Ironically, the failure of mathematical modeling in financial markets seems predestined. To this day, experts often do not outperform random predictions in economics and finance. A joke from Richard Feynman offers a thought-provoking insight:

Imagine how much harder physics would be if electrons had feelings! --- Richard Feynman, speaking at a Caltech graduation ceremony

For economics and finance, future development may hinge more on a deeper understanding of these fields rather than on complex, intricate models and forceful interpretations based on data mining.

Financial markets are a data haven, making it natural to use statistical methods for various predictions, including risk. However, people often fail to distinguish between risk and uncertainty. Risk can be expressed probabilistically, but uncertainty represents the unknown.

Uncertainty can be roughly divided into six levels. The first level is "complete certainty," where all past and future states are known, with no uncertainty. The second level is "full risk," where all future events can be described probabilistically, and we know these probabilities in advance. The third level is "reducible uncertainty," where we are not informed of future event probabilities, but past events develop similarly to future ones, allowing precise future estimates based on past information. The fourth level is "partially reducible uncertainty," where rules change over time, depending on unknown factors, and the future is not a simple repetition of the past. Even with infinite data, this situation cannot be reduced to "full risk." The fifth level is "irreducible uncertainty," where any model or data is meaningless because everything is unknown, a realm more for philosophers and religious leaders. The sixth level is "zen uncertainty," where any attempt to understand uncertainty is meaningless.

The difference between physics and economics lies in the level of uncertainty. Physics mostly exists in the first, second, and third levels, while economics and finance are in the fourth level. Using physics research methods to study finance and economics is inherently limited. The endogenous risk in banking arises from the duration mismatch between short-term deposits and long-term loans. The weak performance of quantitative models in the financial world might stem from the mismatch between research methods and the level of uncertainty in the subjects being studied.

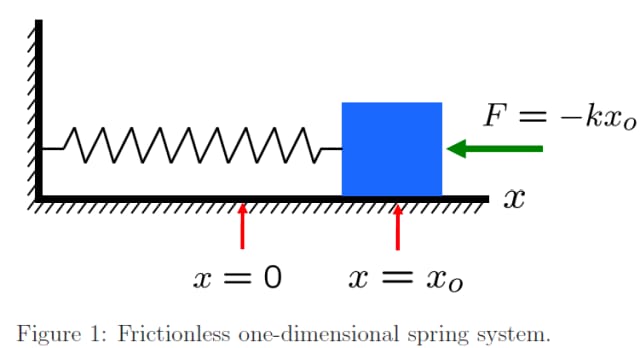

Let's use the position of a block on a harmonic oscillator at a specific time point to illustrate the different levels of uncertainty.

First Level of Uncertainty:

We know F, k, and x0, allowing us to derive the block's position at any given time.

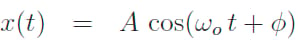

In this scenario, as long as time is certain, the block's position is also certain, as shown below.

Second Level of Uncertainty:

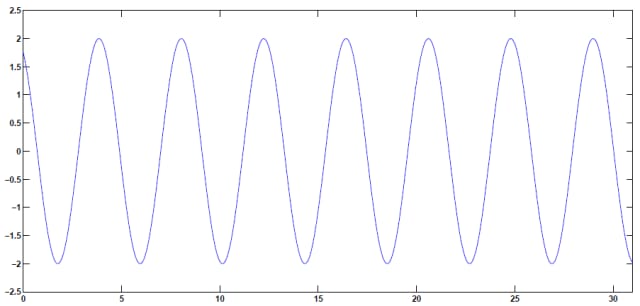

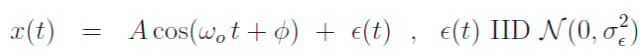

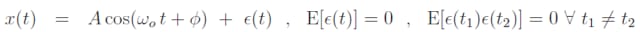

If we introduce a noise term into the above equation, with a known distribution:

Although we cannot determine the exact position of the block at a specific time, we can give precise probabilities for any positional interval, meaning all possible future positions can be expressed probabilistically.

Third Level of Uncertainty:

Unlike the previous model, we no longer have precise values for all parameters, and we can only estimate them based on past block movements.

In this model, although the parameters are unknown, our estimates based on past movements are relatively accurate. Most of the time, we solve financial problems within this framework. However, if the financial world were this simple, it would be much better.

Fourth Level of Uncertainty:

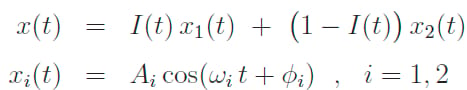

Assume the oscillator's vibrations are not determined by a single model but by two randomly alternating models (with unknown probabilities, similar to Regime Shifting Models in finance and economics):

In this model, making relatively accurate estimates might require decades or even centuries of data. Moreover, this model is hypothetical, and the real world is far more complex. Physics rarely deals with this level of uncertainty, but finance and economics often do.

If people do not believe that mathematics is simple, it is only because they do not realize how complicated life is. --- John von Neumann

Among students, I've noticed a deep faith in mathematics among those with an economics and finance background, often to the point of undervaluing economics and finance while overemphasizing mathematics. I don't think this is advisable. The above classification of uncertainty is not fixed; those with deeper understanding can often downgrade the level of uncertainty. One example is the eclipse cycle. In the past, people did not understand eclipses, and the scant data was insufficient for prediction, classifying it into the fourth or even fifth level of uncertainty. Now, with a deep understanding of celestial mechanics, eclipse predictions can be precise to the microsecond, downgrading this issue to the second or even first level of uncertainty. This is an example of how deep understanding can downgrade uncertainty.

In this sense, overemphasis on quantitative disciplines in economics and finance might not be beneficial. People should focus on deepening their understanding of economic systems and financial markets to reduce their uncertainty.

Does this mean quantitative methods are unimportant? Not at all; quantitative methods are very important. Understanding models is as crucial as understanding economics and finance. Emanuel Derman mentioned an interesting experience at Goldman Sachs. After the Black-Scholes-Merton Model emerged, stock option pricing became systematic, but bond option pricing still lacked a good model. The Black-Scholes-Merton Model could be used for bond pricing in the short term but was unsuitable in the long term because bond termination prices are certain, while stock prices are not. Later, Black, Derman, and Toy developed the Black-Derman-Toy Model for bond option pricing, with assumptions and predictions better suited to reality than the Black-Scholes-Merton Model. However, Derman found that Goldman traders still used the Black-Scholes-Merton Model for bond option pricing, arguing that they could adjust the model's inputs to get the correct bond option prices based on their market intuition. Although the model was incorrect, the results would be correct. Derman then identified several situations where the Black-Scholes-Merton Model could not yield the correct price, regardless of adjustments, and raised concerns about the traders' behavior.

This example is typical. Another is the proliferation of low-priced warrants in the Japanese market in the 1980s, causing significant losses for Solomon Brothers and Morgan Stanley due to incorrect models.

Despising more realistic models and clinging to models commit the same mistake: insufficient understanding. The former involves understanding the model's limitations and methods, while the latter concerns understanding economics and financial markets.

Consider this a rant. Although my work involves quantitative analysis, I cannot stand the current atmosphere of "physics envy." I believe technological advancements contribute little to improving financial market predictions. The real breakthroughs lie in understanding finance and economics, not technology.

Here are the references used in this article, all excellent resources that I highly recommend:

Lo, A.W., & Mueller, M.T., (2010). WARNING: Physics envy may be hazardous to your wealth!.

Mauboussin, M.J., (2007). More Than You Know: Finding Financial Wisdom in Unconventional Places (Updated and Expanded). Columbia University Press.

Derman, E., (2004). My life as a quant: reflections on physics and finance. John Wiley & Sons.

Disclaimer: The data and information mentioned are from third-party sources, and accuracy is not guaranteed. This article shares information and views, not professional investment advice. Consult professional advice before making investment decisions.

This article was originally written in Chinese and posted on my WeChat platform in 2016. The Chinese link can be found here