Introduction

When an ecosystem flourishes, different ideologies emerge. Also as tech became the best-performing sector over the past 10 years, people started to turn to the private market for opportunities. Private markets are no longer just the playground of a handful of venture capitalists. When newcomers enter a new ecosystem, they don’t normally start from scratch, instead they try to (over)-fit their past experience. ‘Quant’ is one of the topics where intuitively it makes sense to consider. However, if we think deeper, it is easy for ‘quants’ to become the excuse for poor investment decisions.

This is Part I of my quant series. In this one, I will give an overview of quants which hopefully sheds lights on what quants can and can’t do. In my next article, I will explain why most of the quant approaches applied to the private market are doomed to fail.

Let’s get started.

It is too easy to generalise a profession, but surely you can’t get an optometrist to perform a heart surgery. Quants are the same - there are many types. We can do a top down approach.

Q Quants and the exiled academics

In general two branches in finance require some level of quantitative modelling, ‘Q’ for derivative pricing and ‘P’ for portfolio management and risk management.

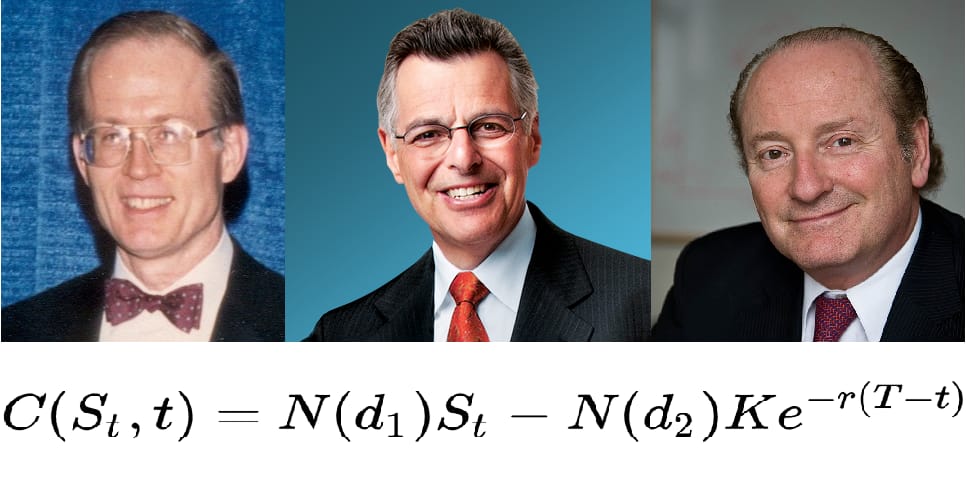

Q quants emerged after WWII when research funding was cut and universities didn’t have the room to absorb an army of new academics. As a result, large number of physicists and mathematicians were squeezed out of the academia and found their way into the wall street. The most famous Q quants are probably the authors of BSM equity option pricing model - Fischer Black, Myron Scholes and Robert Merton.

At that time warrants were traded based on traders’ intuitions, so getting the warrant price right felt like a big deal, as one would think that you can long the underpriced warrants and short the overpriced warrants and make a profit. Fischer Black and Myron Scholes were not good enough in mathematics to invent option pricing model from scratch but they got some inspirations from existing theories in physics around Geometric Brownian Motion. Lucky for them, a neat option pricing formula was produced. Robert Merton, on the other hand, was a young genius mathematician working with the Father of Modern Economics Paul Samulson. He managed to derive the same option pricing formula himself mathematically. If we quantify the degree of Q quants, Merton can be said to be a purist. Contrary to what many people believe, the fact that you can get the price of something (more) right does not mean you can make money from it. In fact both Fischer Black and Myron Scholes lost money trading warrants. Gradually warrants did start to get traded around the price level specified in the option pricing formula.

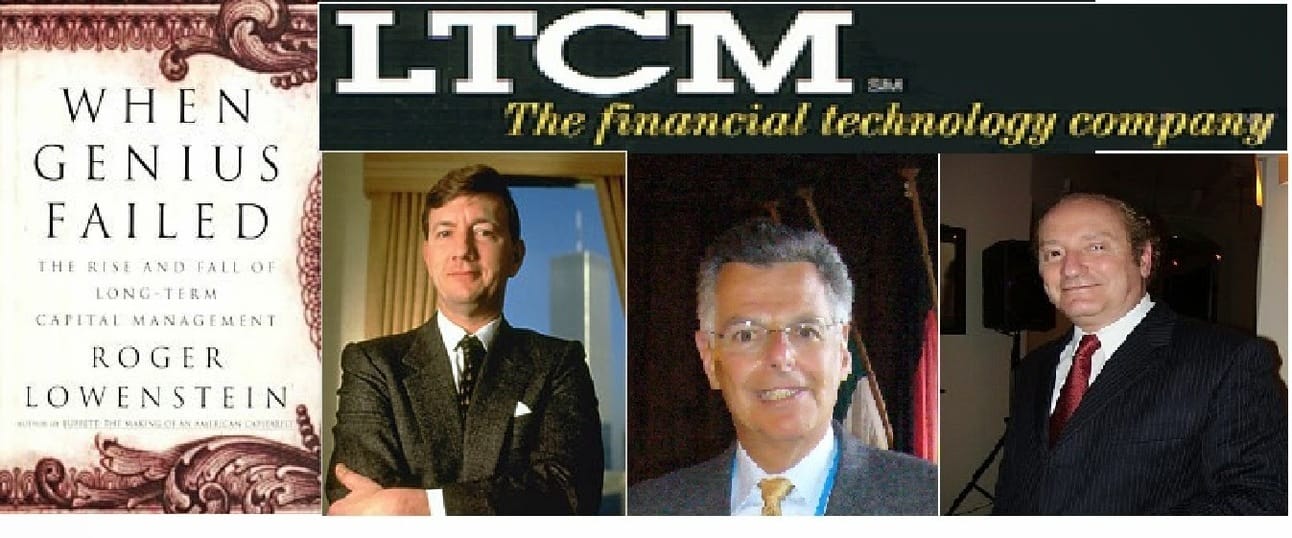

It’s also worth mentioning that Myron Scholes and Robert Merton later went to become co-founders of one of the most famous hedge funds in the 90s, called Long Term Capital Management. I guess we can’t say that losing money trading warrants based on models has nothing to do with the later failures of this star hedge fund. The rest is history.

More needs to use complicated mathematical models to price derivatives arised such as bond option pricing with Black-Derman-Toy model. In fact this model was developed in Goldman Sachs by Fischer Black, Emanuel Derman and William Toy and was published on a practitioner journal Financial Analysts Journal as opposed to traditional finance journals like the Journal of Finance. Emanuel Derman later became the Director of Financial Engineering in the University of Columbia and trained thousands of Wall Street quants over the following decades. He wrote a book about his own experience from an academia in physics to a Wall Street quant which was a great read.

When we talk about financial engineering or a focus on mathematics, we are actually talking about the pricing of complex financial instruments, and they are Q quants.

In more recent years, the most famous Q quant was probably Michael Burry, aka the Big Short. The reason I put him down as a Q quant is because he got into Collaterialised Debt Obligations (CDOs) from reading tedious pricing books and hundreds of 130-page mortgage bond prospectus and understood how CDOs were priced. His construct of CDS was not only a bet on price, but also on timing. This is probably why he is an exception amongs Q quants in the ability to extract profits from the capital market.

Q quants are less known these days given the focus on P quants. But they did not disappear - they probably got larger as financial systems got larger, and less mathematical due to tightening regulations. Imagine the size of debt issuance from corporate and the sheer size of asset based financing, Q is far from dead.

P Quants and the origin of finance

Contrary to Q’s mathematical origin, P was born in the traditional world of finance. Eugene Fama, Father of the Modern Finance, famously proposed the Efficient Market Hypothesis (EMH). EMH quickly swept through the whole academic world and became the gospel in finance. This lasted for decades until a student of his, Cliff Asness, discovered a persistent anomaly in the capital market - momentum. Momentum was not easy to explain under EMH and was independent of the three factors that Fama and French discovered. Then we know what we know today - Value and Momentum Everywhere which was probably the root of AQR, a $100B quant hedge fund today.

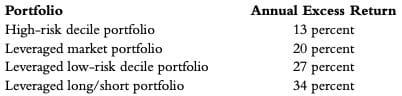

Apart from Value and Momentum, Betting Against Beta (BAB) as a factor was probably discovered at the same time as CAPM (Capital Asset Pricing Model) by Fischer Black as he realised that high beta stocks would be chased after and hence persistently overpriced. If the investment portfolio can remain market neutral by shortselling high beta stocks and using low beta stocks to hedge, and apply leverage to match market level volatility, it can outperform a market portfolio by double digits every year. He was trying to take it further by making it the world’s first index fund Stagecoach Fund in Wells Fargo in the 70s. Unfortunately he lost to a colleague of his for ‘lack of diversification’. This was called the Day Alpha Died. In the end neither of them won, Vanguard won.

As factor investing became more and more popular, more factors were discovered. The famous ones were low vol, short vol, trend following, quality and carry etc from leading academics and portfolio managers, like Andrew Ang, the AQR crew, the Research Affiliates crew etc.

Those factors are normally systematic approaches to help extracting either capital market inefficiencies resulted from persistent human biases or alternative risk premia in an independent dimension. Due to the natures, there is an interesting observation: it actually does not matter how you construct the factors; the anomalies should be persistent and robust. Viewing it from a different lens, factors are long term inefficiencies that can be explained in human language. P Quants don’t mine the data for ideas - instead they generate ideas based on known facts, and construct factors based on them. This means that P quants are mostly investment experts, as opposed to mathematical or programming experts.

Replicating Buffet

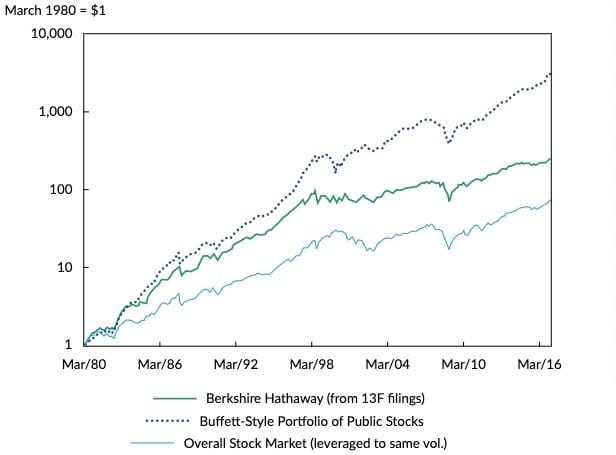

One of the highlights of factors discovered by p quants is that a lot of legendary investors can be demystified, as quants decoded some of the traditional alpha and make them readily accessible. Technically one can be close to a legendary investor by investing in similar styles as them algorithmically without having to replicating their exact holdings at any given time. This also reduced the fees associated with capturing those premiums from 2/20 to less than 50 bps.

The most famous example was probably AQR’s research on Replicating Buffet. It proved that it was not only possible to match Buffet’s performance, it was actually possible to outperform Buffet easily.

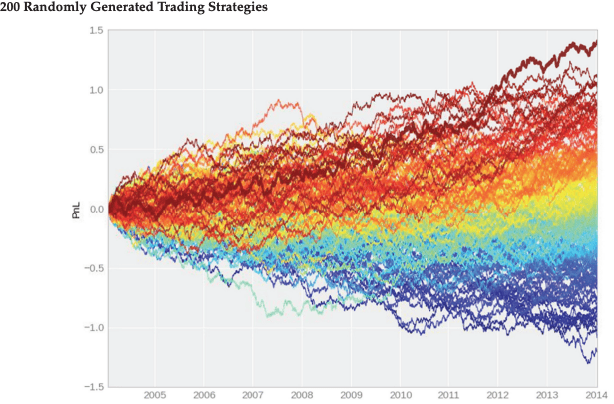

Factor Zoo

Later things got a bit out of hands - there were over 400 factors reported in top finance journals alone, according to Campbell Harvey. Based on Harvey’s research, majority of the newly reported factors have high correlations to known factors which suggested that they are not new factors but existing factors constructed with a slightly different approach. In addition, new factors started to lose the robustness traditional factors like value and momentum have, suggesting that some of them were just statistical coincidences when academics mine the data hard enough without testing the statistical assumptions properly.

A by-product of this finding is a scary realisation: return sources from the public market may be limited and might already have been captured. This is probably also a contributing factor behind alternative assets’ popularity in recent years. Needless to say, this is a reason why I am cautiously optimistic about some opportunities in the private market.

What about Jim Simons and Renaissance Technologies?

Some may use Jim Simons and Renaissance Technologies to prove the existence of data/math driven P Quants. It is true - but there are more to it.

I read large number of articles about Jim Simons and the book The Man Who Solved The Market. Unfortunately it is very hard to know the strategies he deployed or even the approach he deployed, unlike the case of most quant hedge funds like AQR or systematic macro like Bridgewater.

However, three things he said left me deep impressions. They are as below

“Luck, is largely responsible for my reputation for genius. I don’t walk into the office in the morning and say,”Am I smart today?” I walk in and wonder, ‘Am I lucky today?’”

— Jim Simons

“We don’t start with models. We start with data. We don’t have any preconceived notions. We look for things that can be replicated thousands of times. A trouble with convergence trading is that you don’t have a time scale. You say that eventually things will come together. Well, when is eventually?”

— Jim Simons

“We search through historical data looking for anomalous patterns that we would not expect to occur at random. Our scheme is to analyze data and markets to test for statistical significance and consistency over time. Once we find one, we test it for statistical significance and consistency over time. After we determine its validity, we ask, ‘Does this correspond to some aspect of behavior that seems reasonable?’”

— Jim Simons

The first statement is about luck, the second statement is about convergence in unknown time window, and the third statement is about statistical significance and rationale.

When it comes to luck, in the book The Success Equation, Michael Mauboussin proposed a method to check if something is pure luck, pure skill, or a mix of both. The test is whether you can deliberately lose. When we look at the stock market, many people assume it is a skill-based game. However, if we apply this method and ask, ‘can you pick a stock that will definitely lose money tomorrow?’. The answer is no. We need to keep in mind that active investment is a game where luck dominates (with some if conditions). Some may say Jim Simons is deliberately hiding his secrets but I do think he was telling the truth - there might be an element of luck in his amazing track record.

The second point around convergence is an interesting one. Many say that Jim Simons doesn’t hedge. I take it differently. If we look at the history of the stock market, it was just over 100 years. If we look at returns on an annualised basis, we barely have 100 data points including some really bad ones. If we further cut it by market regimes, in each market regime, we probably have less than 30 data points. This is saying, 100 years may look long and we may think we’ve derived some rules about how the market operates in the long term, but in reality, the past 100 years doesn’t even provide enough data to get to statistical significance.

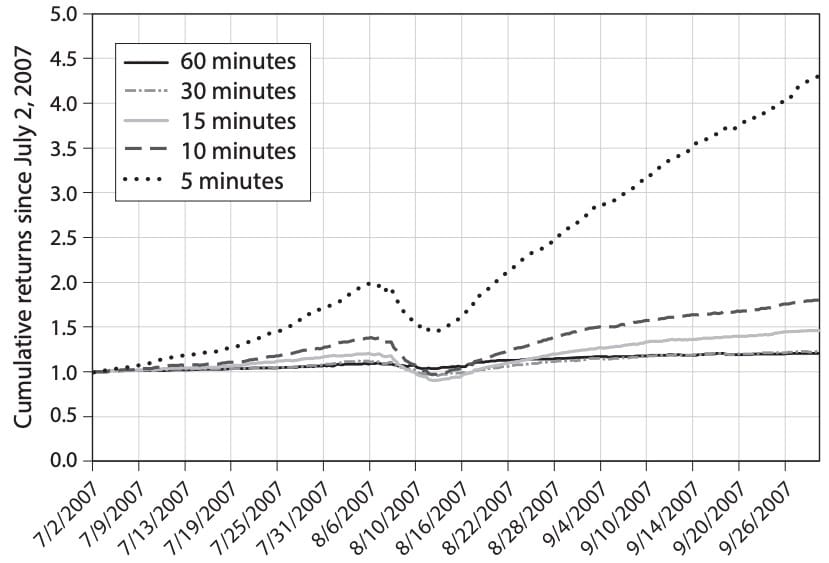

However, if we take a fractal view of the market, 100 years means 36,500 days, 876,000 hours, 52,560,000 mins and 3,153,600,000 seconds. By focusing on smaller time intervals, we have more than enough data to reach statistical significance even considering market regime shifts etc, and have closed to 100% likelihood of convergence in time units that can be perceived by humans, and potentially uncover more ground truths about the market than what traditional finance literature suggest. In addition, most people in the investment world play the low frequency, long term game due to a lack of computing skills and infrastructure, so alpha from Jim Simons’ amazing performance could result from the opportunities brought by a lack of compeition from intraday quant strategies (I deliberately chose not to use HFT because it doesn’t have to be low latency and also HFT is mostly a market making mechanism as opposed to investment management). This is supported by data even from recent times. For example, a simple rule-based strategy can yield significant returns over 5-mins intervals during 2007 Quant Meltdown.

Using information ratio to look at Jim Simons’ performance driven, apart from a much higher breadth than long term investments, he might also have a high IC.

IR=IC∗sqrt(Breadth)

This is supported by two observations, one is that Renaissance’s Medallion Fund is not open to the public which is a common characteristic of a strategy with capacity constraints and transaction cost considerations. And the other is Medallion Fund’s significant outperformance over the long term funds that Renaissance offers to the public.

The last statement he made was relatively simple. We need to make sure 1.) the findings are statistically significant 2.) the findings have an explanation.

My controversial take here is that, Jim Simons is not fundamentally different from the factor-based P Quants. His main difference is that he operates in a different time window that has more data to support more time-based, higher premium opportunities, and he does investment research better so they are less likely to be false positive.

His business model can’t be commoditised as ETFs thanks to lucrative return potentials and low capacities relative to the capital the world has.

Conclusion

I’ve covered P and Q quants and deliberately left out the risk quants as they are less relevant to investment management. In short, Q Quants are doing pricing, and P Quants are theory-driven and relying on data as feedback. In the coming articles, I would share my take on quants in the private market and why I think most of them are doomed to fail.