Covered Call Writing (CCW) is one of the most popular options strategies. It seems very simple, but it is actually quite complex. A deep understanding of CCW can improve the risk-adjusted returns of traditional CCW strategies.

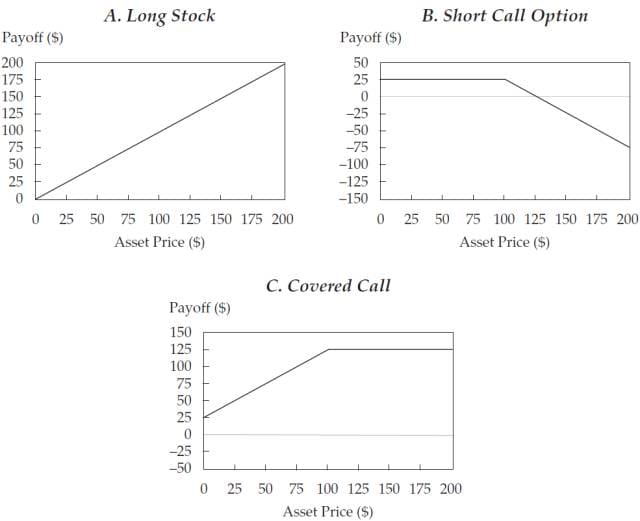

Holding a stock and then selling a call option on that stock is what constitutes the CCW strategy. The CCW strategy is extremely simple and is frequently used, even by non-quantitative investment managers. Due to the non-linear return structure of the CCW strategy, the alpha generated by linear regression in this strategy does not actually exist, at least not in the traditional sense of alpha that we expect. Besides branding CCW as an alpha strategy, there are many misconceptions about this strategy in the industry, all stemming from a lack of deep understanding.

I am not writing this article to deny the CCW strategy; it has been very successful. The most basic version of the CCW strategy has already achieved a higher risk-adjusted return than the stock index. However, there is more to the story behind it. This article involves some knowledge of volatility and options, which might be more challenging than previous articles.

This article is divided into three parts: the first part is about the historical returns of the strategy, the second part is about the characteristics of the strategy, and the last part discusses the essence and optimisation of the strategy.

Empirical Performance of CCW

The most straightforward way to measure a strategy is its historical return, but the most important aspect is the investment story behind the strategy. In this part, we first look at the historical returns of CCW.

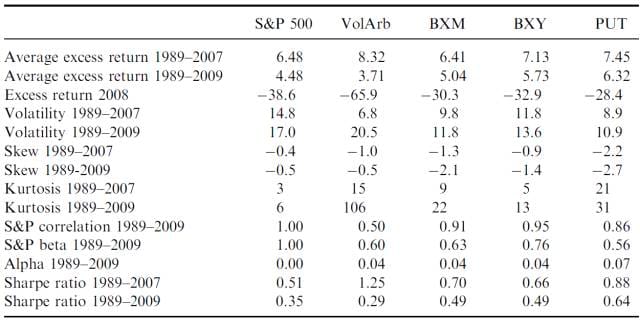

For call options, we have two choices: ATM (At The Money) call options and OTM (Out of The Money) call options. In the Black-Scholes-Merton world, both should have the same implied volatility, but in the real world, this is different (Volatility Smile and/or Smirk that appeared in the 1980s). The benchmark indices for ATM CCW and OTM CCW are BXM and BXY (with S&P 500 as the underlying), respectively. By the way, PUT is the benchmark index for the equivalent strategy of put options (Collateralised index put selling). Another strategy related to CCW is called Volatility Selling, the most direct trading product of which is Variance Swap, an OTC (Over The Counter) rather than ETP (Exchange-Traded Product) product. Sometimes Volatility Selling is also referred to as Volatility Arbitrage, although it is far from true arbitrage.

These data are public, and I directly quote the analysis done by others. You can also analyse the data yourself.

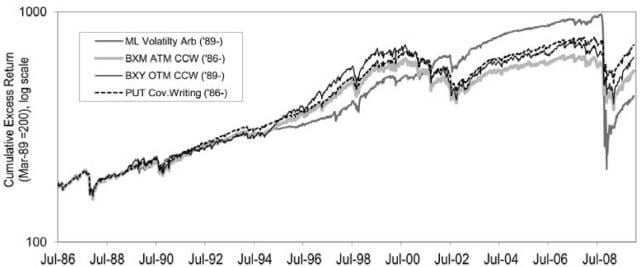

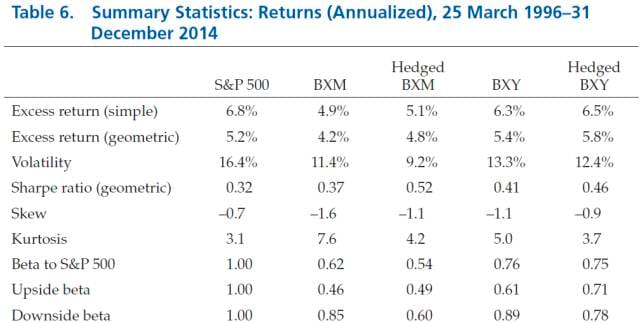

As shown in the chart above, all four strategies mentioned are profitable in the long run.

The returns of CCW are similar to those of the S&P 500, but the volatility and drawdowns are significantly smaller than those of the S&P 500. This means that they have higher risk-adjusted returns compared to the index, making them very attractive long-term strategies. Some might mention the significant drawdowns shown in the chart; in fact, the performance of the S&P 500 was worse during the same period, except for VolArb.

Stories Behind Covered Call Writing

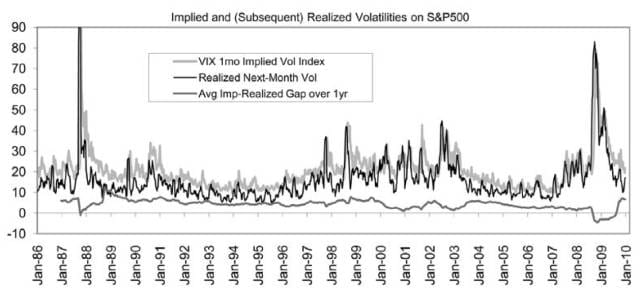

The long-term returns of CCW mostly exist in indices and rarely in individual stocks. There are several reasons for this, the most direct being that in indices, implied volatility is usually higher than actual volatility. This is called volatility premium, sometimes referred to as volatility arbitrage, where Variance Swap refers to the swap between implied volatility and actual volatility.

This phenomenon does not exist in most individual stocks. In individual stocks, implied volatility often matches actual volatility. An exception is high-risk stocks, where implied volatility can still be higher than actual volatility, but this could also be due to the volatility effect, so investors have certain expectations of volatility (high volatility can predict low future returns).

One can imagine that a profitable long-term investment strategy is to short index options and then long individual stock options that are highly correlated with the index for hedging. In fact, some investors do use this strategy.

Upon careful consideration, I did not actually answer why CCW only exists in indices. The explanation regarding implied volatility is just a manifestation, not the root cause. What I need to explain is if there is a volatility premium in indices, it means that selling index options has an extra layer of risk compared to selling individual stock options. What is this extra layer of risk?

There are many possible explanations, but the one I find most convincing is the Correlation Premium. We all know that the volatility of an index reflects the weighted average of individual stock volatilities plus their weighted average correlations. From this relationship, we can infer that the index volatility rises faster than individual stock volatility due to the correlation among individual stocks in the index. Therefore, it is reasonable for investors to demand a correlation premium.

Understanding the Risk Nature of CCW

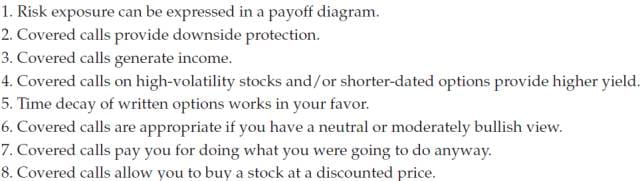

There are many rumours about CCW, but not many facts. One fact is that CCW involves market risk and volatility premium. Common misconceptions include:

These are common but incorrect. In fact, the fact mentioned above is not entirely accurate either.

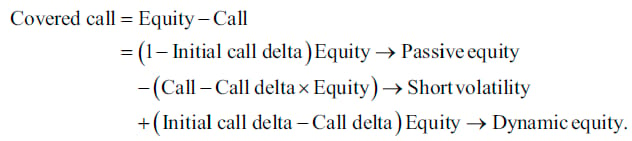

CCW can indeed be seen as being long the index and short options, but this deconstruction is not complete and can go deeper. Besides market premium and volatility premium, CCW strategy also includes an additional component, which is market timing, as shown below:

The net risk exposure of the last component, dynamic market risk, is zero, with real-time risk exposure changing with the index price, essentially being market timing. The source of this dynamic market risk is the option's gamma, meaning the option's delta changes with the underlying price. In the context of an efficient market, timing itself does not bring any positive returns but adds extra volatility to the strategy, which is the imperfection of traditional CCW. I know many friends will focus on market efficiency, and my view is that, regardless of market efficiency, timing is almost impossible.

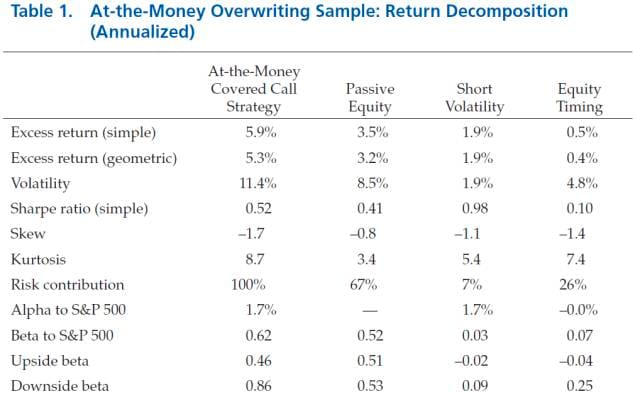

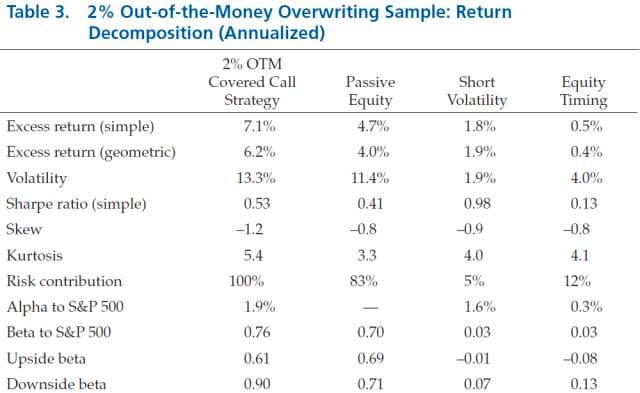

The charts below show the breakdown of ATM and OTM CCW strategy returns into three components: Passive Equity, Short Volatility, and Dynamic Equity.

It can be seen that the short volatility component of CCW brings excellent risk-adjusted returns, while the return from the market timing part is not significant but significantly increases the strategy's risk. An obvious improvement is to hedge the market timing component in CCW, leaving only the Passive Equity and Short Volatility components.

As expected, the risk-adjusted returns of the CCW strategy improve after hedging the timing component, whether ATM or OTM, as shown below:

This is a pleasing discovery, but it is not a new one. The essence of these improvements is the logic behind factor investing (refer to "A Better Way to Invest: Factor Investing (I)"). Decomposing an investment portfolio's return into alpha and premiums brought by various factors, including value, trend, quality, market, carry, profitability, etc., and other components like timing and unintentionally paid insurance premiums. One can optimise the first two and reduce or eliminate the latter to achieve an effective factor strategy. The improvement in CCW stems from removing the timing component, which did not provide attractive risk-adjusted returns. But is the strategy optimal after this? I don't think so. In the improved strategy, market risk is 10-16 times that of volatility risk, which is not an effective factor allocation. According to Ray Dalio's risk parity principle, a 50-50 risk allocation between the two would yield better risk-adjusted returns. But is that the end? Not really; we can combine other factors to create a more diversified portfolio.

Currently, there are more and more factor investing ETFs on the market, but most are Smart Beta (Factor + Market) rather than pure factors (Long/Short Factor). The volatility selling mentioned here and the carry mentioned in the previous article are good factors, but no suitable low-fee ETFs have appeared yet, so it is still difficult to construct an effective factor portfolio through ETFs. Besides investing, understanding investment itself is also a gratifying thing.

Delving into options topics is not simple and requires a certain level of financial literacy or even mathematical knowledge. I hope my explanations are acceptable to everyone.

References:

Ang, A., 2014. Asset Management: A Systematic Approach to Factor Investing. Oxford University Press.

Fallon, W., Park, J., and Yu, D., 2015. Asset Allocation Implications of the Global Volatility Premium. Financial Analysts Journal, 71(5), pp.38-56.

Ilmanen, A., 2011. Expected Returns: An Investor's Guide to Harvesting Market Rewards. John Wiley & Sons.

Israelov, R., and Nielsen, L.N., 2015. Covered Calls Uncovered. Financial Analysts Journal, 71(6), pp.44-57.

Israelov, R., and Nielsen, L.N., 2014. Covered Call Strategies: One Fact and Eight Myths. Financial Analysts Journal, 70(6), pp.23-31.

Disclaimer: The data and information mentioned are from third-party sources, and accuracy is not guaranteed. This article shares information and views, not professional investment advice. Consult professional advice before making investment decisions.

This article was originally written in Chinese and posted on my WeChat platform in 2016. The Chinese link can be found here