Introduction

Residential real estate is one of the most popular asset classes in Australia. It is at the heart of the Australian dream due to its features of high accessibility, large financial impact, and historically longstanding prosperity. However, the downside of being easily accessible and having a high financial impact is that there are high-profile yet uninformed financial opinions in this space that can disproportionately hurt certain segments of market participants.

This article aims to document my way of thinking about property returns. To my surprise, even decomposing property returns can already allow one to identify top-performing properties, without having to construct factor models akin to those in other capital markets.

Constituents of Property Returns:

Rental Yield

Capital Growth

Yield Enhancement

Development Potentials

Relative Values

Is It Just Rental Yield and Capital Growth?

There is a common perception that residential property investment is about choosing between rental yield and capital growth. High rental yield properties have low capital growth and vice versa. While both rental yield and capital growth are important constituents of property total returns, there are many problems with this line of thinking.

Neglecting Asset Type - Commonly used examples involve comparison between houses and strata-titled properties (apartment, unit, townhouse, or villa). While it is true that strata-titled properties do have higher rental yield and lower capital growth, this is something driven by the asset type difference as opposed to proving the existence of the inherent relationship between rental yield and capital growth. A more reasonable question to ask is, for two houses with different rental yields, does the one with higher yield tend to have lower capital growth?

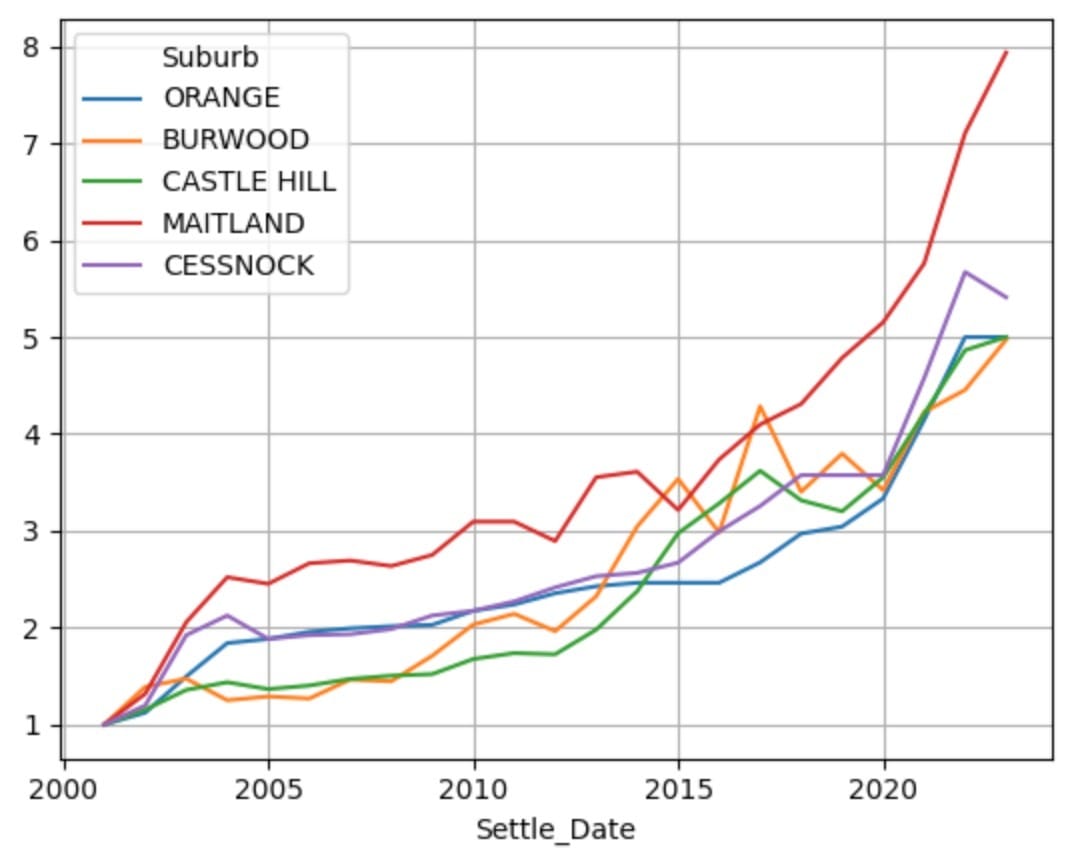

Neglecting Regions - Other examples involve comparing Sydney with regional areas or other states, assuming Sydney’s growth is unmatchable. While regional areas and other states do tend to have higher yield than Sydney, it is not true to assert that their capital growth is necessarily less than Sydney’s. One such example is Maitland, which has persistent, long-term outperformance over almost every single Sydney suburb despite having higher rental yields.

Neglecting Natural Relationship - In fact, there does exist a robust and natural relationship between capital growth and rental yield. One factor that links between them is the price. When you overpay for an asset, your capital growth will be suppressed and the rental yield will also be low. By contrast, if you manage to acquire an asset lower than its fair value, the rental yield will be high and the capital growth will also be high. By this token, everything else held the same, low rental yield is often coupled with low capital growth, not the other way around.

It is also important to note that this relationship driven by under/overpaying an asset might be short term and get diluted over time. Once market price reflects correctly on the property’s fair value, rental yield will be adjusted accordingly. This is a place where a lot of digital buyer’s agents produce misleading information as they never calculate the rental yield based on the updated market price.

Having said above, this is not saying that high capital growth properties with low rental yield don’t exist, but a reminder that their high capital growth is not a result of low rental yield but something else, like development potentials, large land relative to size of property, or undercapitalisation.

Neglecting driver of growth - This is linked to some factors mentioned above. When people expect high capital growth in a particular property or suburb, it’s important to consider whether there exists a robust underlying reason behind it. It could be a result of a complex system where momentum breeds new momentum, and it could also be an assumption that a siphon effect between the capital city and its adjacent regional cities will result in an increasing disparity in population and growth. After those assumptions are put forward, each of them can then be validated/invalidated.

Rental yield can be estimated with a high degree of certainty, given that rent is highly predictable and price is known. Capital growth is less certain. I didn’t have high expectations for accurately predicting capital growth, as I assumed it would be like the stock market. However, after some initial testing, I realized that the growth of one cluster of cities can be predicted with reasonable accuracy. This level of predictability looks like arbitrage, which we don’t normally expect, given that arbitrage is mostly short-lived. After putting some thought to it, I think it might have a longer lifespan in residential real estate because of the high number of retail participants, low transparency, low liquidity, and ultra-strong home bias.

Yield Enhancement

This is similar to the concept of credit enhancement in securitisation, where some level of intervention has a disproportionate impact on asset values. In the context of residential real estate, yield enhancement can be achieved through renovation or building a secondary dwelling, also known as a granny flat.

In Sydney’s inner suburbs, it is fairly common to encounter rundown properties with million-dollar price tags. These properties will have ultra-low rental yields because of their appearance. For example, a $2,000,000 property in Summer Hills could have a rent of $800 pw, reflecting a rental yield of just 2.08%.

However, most of the time, a low-budget renovation could boost the property return significantly. It’s not uncommon to see a renovation costing $80,000 lead to a rent increase of $400 pw, and the annual yield for the renovation part is over 25%, enhancing the overall yield to 3% p.a. for the given example.

The other example is adding a secondary dwelling/granny flat in the backyard (applicable for certain properties in certain states). The rental potential of those granny flats could range from $400 to $800 pw with a cost of $120,000 to $200,000, depending on the location and quality of finish. It is not uncommon to expect over 15% of yield from granny flats, which in turn boosts the overall yield of the entire property investment, hence the name Yield Enhancement.

Development Potentials

If a property has a low rental yield without any space for yield enhancement and is situated in a low-growth region, does this signal a bad investment? Not necessarily. Sometimes properties have imminent development potentials. A property could have a recent change in zoning or is in a high-density zoning area where developers are often willing to acquire it at a high premium to its market value.

However, the appropriate premium varies by a number of factors, and this is an area where extensive due diligence is required. The first factor is heritage overlay. It is highly unlikely for a property with heritage overlay to have significant development potentials. Even for those that do, there could be massive public controversies where developers could face significant losses if the right to develop land with heritage significance is deprived of. One recent example is Glenlee, a 2.5-hectare historic property fronting the Georges River on the Lugarno peninsula.

Also, the premium is inversely proportional to the expected time and probability of being developed, similar to a typical therapeutics deal. For an R4 property which is expected to be bought by a developer in a year, the loading on the development potentials component could be 100%. If this horizon is expanded to 10 years, its loading will just be 7.2%. And if the probability is 50%, the loading would further reduce to 4.1%. In general, development potentials are a significant return driver on average, but the actual outcome for individuals holding properties with development potentials is likely binary: those who can hold till development acquisition happens and those that can’t or development does not happen.

Relative Values

The last part that can impact a property’s return potentials is how much you pay for it. This sounds obvious, or even a bit dumb. However, relative value to fair price is what I mean. If you are able to acquire an investment property at 4% yield in a suburb with an average yield of 2%, then this is great value for you because you are buying the property at almost a 50% discount. In contrast, if an area has an average yield of 6% but you are pricing a property at 4% yield, it means you are paying a 50% premium over the area’s average property. Value does play a role in overall returns.

Many people claim that expensive properties have high returns and the cheap ones stay cheap. This is probably the next level of stupidity. However, one scenario where this could hold true is that the expensive property is in a high-growth area and the cheap property is in a disappearing area and the holding period is long, allowing other return drivers to play a dominant role over relative values.

Relative values are similar to development potentials in a way that its advantage decreases by your holding time. If you manage to buy a property at a 30% discount and flip it in a year, then the gain would be 42.9% p.a. However, if you are holding it for 10 years, the cheapness factor will just be 3.6% p.a. If all other return drivers are mediocre for the investment purchase except for the relative value, it might be worth flipping it as soon as feasible.

Buying properties with a discount sounds like mission impossible. However, people tend to agree that it is very likely to overpay for a property. This is likely due to personal experience and the fact that most people by default position themselves to be purchasers. In fact, it is totally possible to acquire properties at a discount, especially for those properties with low liquidity or special situations. Agents sometimes facilitate this type of transaction knowing the property price is lower than the fair value because their ultimate job is to facilitate the transaction as opposed to helping the vendor get the best price. This type of screening might best be performed by computers, and you would also need to have an accurate view on the fair price of a property.

Conclusion

The way I approach property returns is that:

R(Property) = SUM(Rental Yield, Capital Growth, Yield Enhancement, Development Potentials, Relative Values)

It is fairly obvious why new apartments are bad investments, as their loadings are low across all return drivers. For house investments, quantifying each component for each property and doing so at scale could lead to high-alpha property investment that will have high investment upsides and low downsides. When coupled with the high leverage common in the real estate industry, the absolute returns of successful property investments could be extremely lucrative.