Just when everyone categorically named the 2021 investment craze as ZIRP, the majority of risky assets have long smashed the 2021 record highs, including real estate, stocks, and even cryptos, in a world where money has become very expensive.

From a finance perspective, today’s asset prices are much more speculative than the 2021 prices, yet people and the market appear to be a lot calmer. Just when people normalise high returns, the real danger lies ahead.

When Future Returns Are Brought Forward

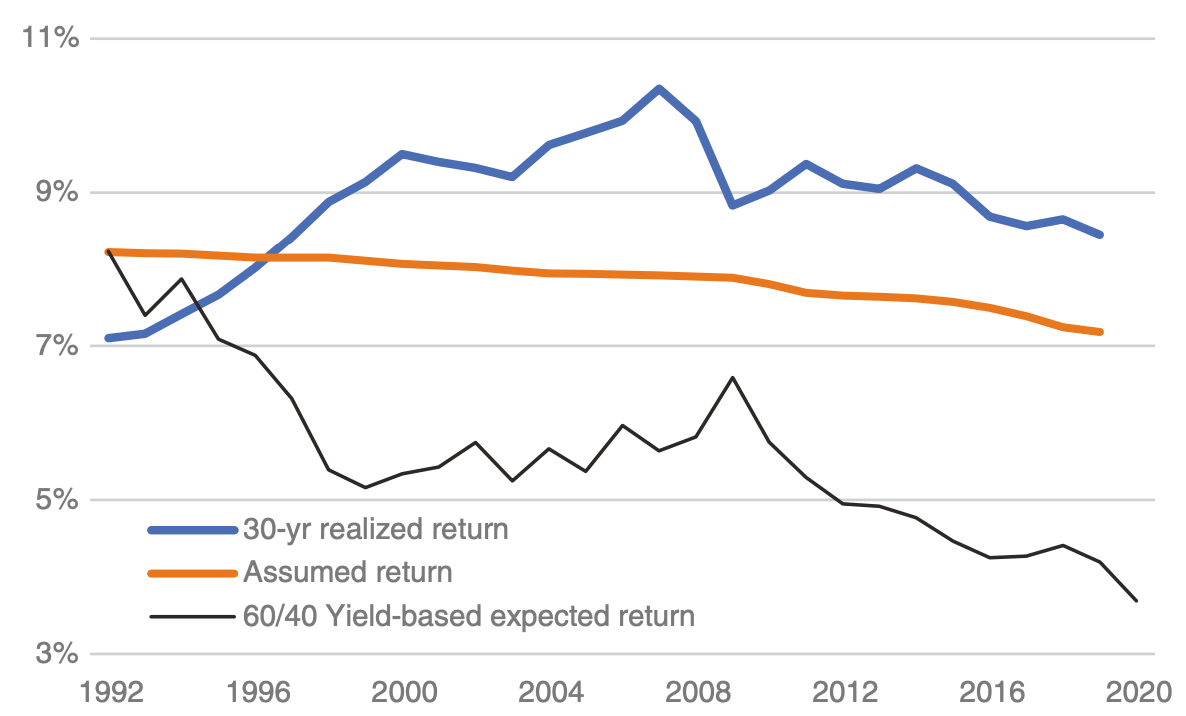

When it comes to returns, there are ex-ante returns, referred to as expected returns, and ex-post returns, referred to as realized returns. When long-term returns are constant, high realized returns suggest low expected returns, essentially meaning the asset price inflation our generation enjoyed so far is a result of bringing forward future returns.

2021 was bad enough, but to be fair, it was in a world where the discount rate was low and money was cheap. 2024 is arguably a lot worse, with the high cost of capital colliding with high asset prices, combined with investors’ rearview expectations that good returns will continue to last.

Investor Options

When expected returns are low, what options do investors have?

The first option is to cope with it and accept a lower expected return for the future. This sounds pessimistic, but I’d argue it should be a base scenario that every investor keeps in mind, similar to how active managers understand that outperforming the market index is difficult in the long run. Such understanding can help reduce complacency and reckless risk-taking when the market is expected to offer a lot less for the same amount of risk taken.

The second option is to allow more risk budget and hope to avoid a lower expected return. Given the world is obsessed with absolute returns as opposed to risk-adjusted returns, this is an extremely common choice across multiple asset classes.

In the private market, late-stage VCs are piling into early-stage startups over the last few years, hence valuation-wise, seed and pre-seed never truly experienced the significant changes that late-stage startups face due to multiple compressions.

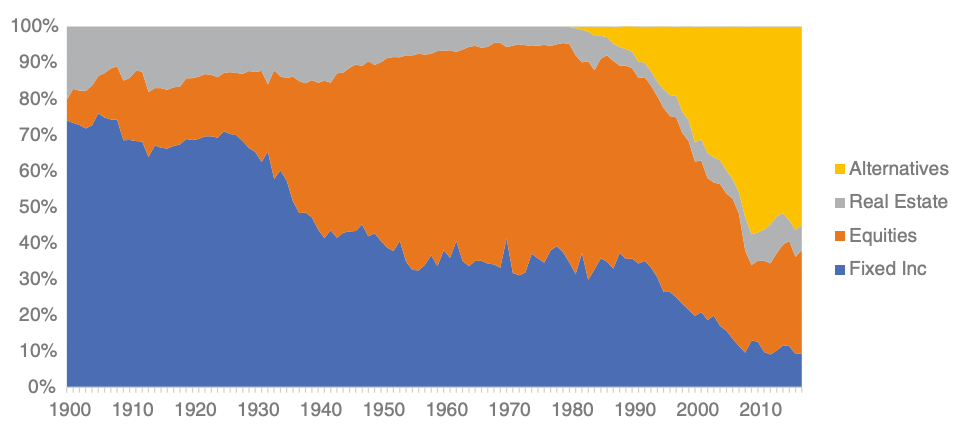

Large asset owners like endowment funds are trimming down fixed-income assets in their asset allocation and turning to risky assets like equities, and subsequently private equities, in recent decades.

Evolving Asset Allocation for Large US Endowments, 1900–2017

The last type of investors are the rarest—they avoid looking at overpriced markets and instead turn to return sources that are not overpriced (alternative beta). Even better, some have a unique edge to generate outperformance (alpha). All active managers claim to have alpha, as sales as opposed to investment management is the main part of the job these days. True alpha providers aren’t accessible to most people, so we will mainly focus on alternative beta in this context.

Market indexes represent the most understandable beta but are also most subject to boom-bust cycles due to their accessibility. However, there are other betas like value, momentum, quality, etc. They are almost always less crowded than the market beta because:

The need to construct long/short pairs is not intuitive.

Shorting is fairly market-constrained.

They generally require leverage to be attractive in a portfolio setting, but most people have strong leverage aversions.

Some of them aren’t just immune to high asset prices—they could actually benefit from high asset prices.

Emerging Opportunities

If we go one step further, we should be asking about the emerging opportunities amid high asset valuations. This is like building a startup where we need to understand the problem rather than start from a solution.

High valuation is not felt evenly across all assets.

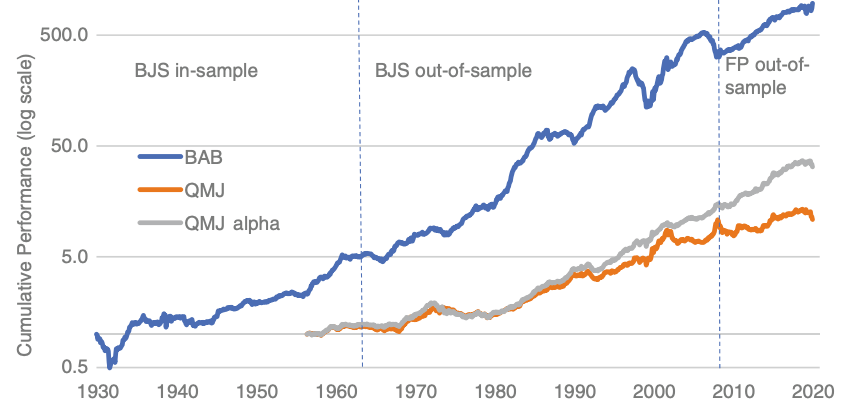

When investors want to chase absolute returns but have no means to leverage, what do they do? They will pile into high-beta stocks, resulting in higher compressions of high-beta stocks’ expected returns. When one holds low beta stocks and short out high beta stocks to remain market neutral, other people’s risk seeking can be monetised as a pure investment exposure.

Betting against beta historical performance between 1931 and 2021

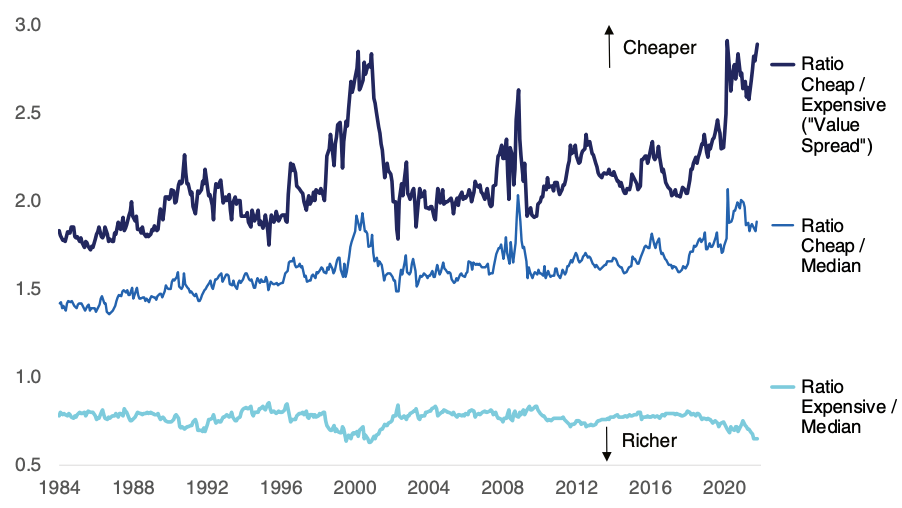

When markets are making highs, a subgroup of sectors are the main contributors. Power law dynamics are not just for the private market—they exist everywhere. The most recent waves are made by large-cap tech stocks. At the same time, the value spread is larger than ever, indicating extremely attractive expected returns for value investing relative to growth investing.

Value Spread History in the US

If the search space is further expanded to real assets, a curious mind will always be able to find niche investment opportunities too unscalable to draw serious attention from career investors but by themselves present seriously good returns for individual investors.

Optimist? Yes and No

Money managers like to claim they are optimists. The bad news is that the market as a whole doesn’t have much room for optimism in the future, so money managers’ optimism may be a sales line, especially if they don’t have a deep skin in the game. Be really careful with what you are paying to get if you are handing over your money and the investment decision to someone else.

For people managing their own investments, it is important to be an optimist for different reasons. One is that even if the market is expected to offer much less, not participating means getting nothing. Two is that it is the optimists who will find good opportunities, rather than the pessimists who are forever trapped in a never-ending negativity loop.

Reference

Inspired by Antti Ilmanen’s most recent book - Investing Amid Low Expected Returns