Introduction

People often invest in areas they believe they understand. However, mere familiarity is seldom enough to generate alpha, especially given the marketplace’s maturity for most assets. Just because your neighbor is selling doesn’t mean you can acquire their property for less than its market price. Conversely, if you’re buying in an unfamiliar neighborhood, you might end up paying significantly above the market price due to information asymmetry.

On one hand, expanding their search space is crucial for investors aiming to generate alpha, as finding undervalued assets in familiar territories is challenging. On the other hand, becoming prey to information asymmetry and overpaying for assets is expensive. Striking the right balance requires skill and insight.

Scalability’s Enemy

Every day sees thousands of listings across various suburbs, with many not revealing a price guide. Evaluating properties individually to find the best deals is arduous. Consequently, the optimal solution should be scalable, breaking down properties based on quantifiable value components. I’ll delve deeper into this in a separate post.

However, value calculation is only half of the equation. No matter how outstanding a property might be, if its price exceeds its intrinsic value, it’s not a sound investment. The majority of property listings in New South Wales don’t provide a price guide. Among those that do, many are either underquoted (often before auctions) or overquoted (typically for properties in regional areas or long listings). This lack of reliable price estimations hampers investors’ ability to effectively scout for attractive investment opportunities.

Existing Solutions

Current data vendors like APM, PropTrack, and Corelogic all offer property price estimates. But their solutions center on individual properties, targeting investors who first shortlist desirable properties before checking their prices. I believe property prices should be an initial screening factor, not an afterthought. After all, every property, regardless of its condition, has a price point making it a potentially valuable investment.

Scalable solutions like APIs are costly and typically target developers or large-scale PropTech firms, not individual investors. Moreover, these models are proprietary. The substantial price variances between the three main providers suggest there’s ample scope for refining their estimations.

However, the fact that these three vendors might not have optimal models doesn’t justify investors developing their own. The complexities of data collection, linkage, model creation and refinement, and the supporting engineering infrastructure render it inefficient for individual investors purchasing just a handful of properties.

Some may suggest that buyer agents are the answer. Based on my experience and observations, I’d argue their involvement often results in systematic underperformance in property investments. A word of caution: there are myriad reasons buyer agents may not serve investors’ best interests, which I won’t detail here.

Investors need a simpler, more affordable solution.

The Secret Behind Land Values

In my previous post, Momentum in the property Market, I highlighted the idea that land value underpins house value. This probably sounds dumb as many think house price is just land price plus construction costs. This is not strictly true but there does exist an intricate, mathematical relationship between house price and land price, because land price isn’t simply the cost of the land itself but is derived from surrounding house prices and other influencing factors.

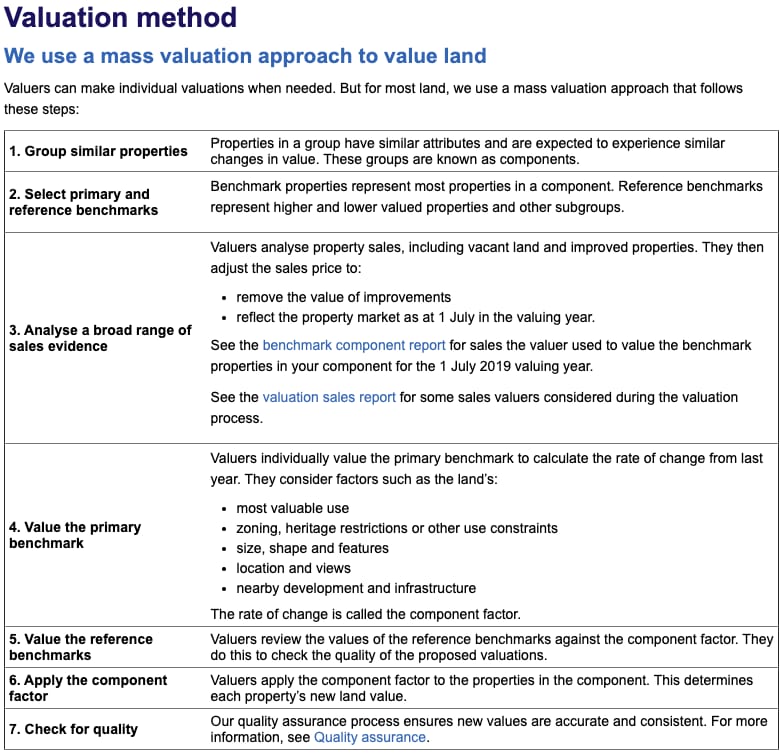

The valuation method of land price already considers the following factors that we add to our mental accounting when estimating the house price

most valuable use

zoning, heritage restrictions or other use constraints size,

shape and features

location and views

nearby development and infrastructure

A provocative assumption we can make is that, we can reverse-engineer house prices using land values.

The Magic Formula

Utilising land prices to gauge house prices isn’t a novel concept for seasoned investors. However, adjusting for macro-market shifts relative to static annual land price updates and considering region-specific relationships makes the process less straightforward.

Recognising the market’s dynamism means relying on a static land price factor is inadequate. Instead, we can determine the monthly ratio of house prices to land prices at the suburb level, providing insight into their relationship.

While this approach may seem simplistic, its efficacy is notable.

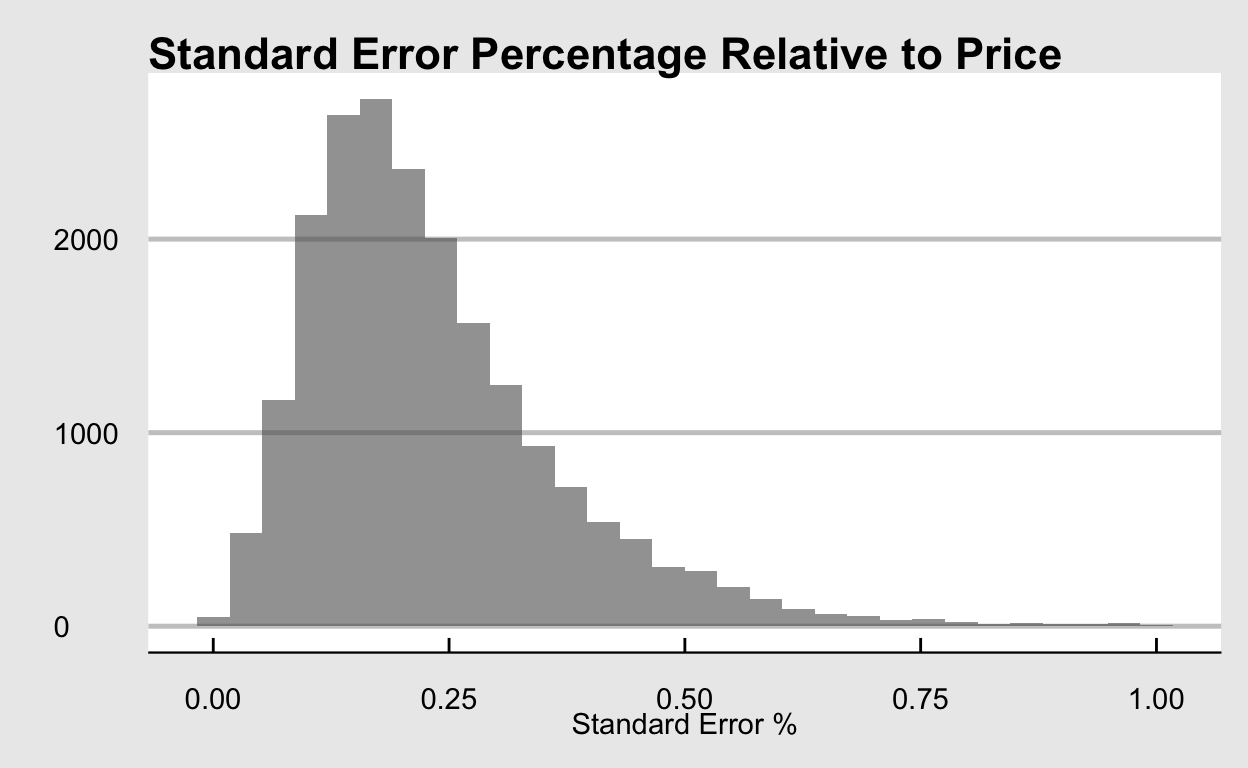

The standard error percentage, derived from the ratio’s standard deviation and the ratio itself, indicates impressive results. In non-regional areas over the past five years, over half the actual sold prices fell within a 15% deviation from the estimated values. This accuracy competes with many commercial solutions.

Final Note

This method, while simple and basic, has a strong predictive power, making it viable for investment evaluations even in its current form. Its scalability allows investors to assess numerous opportunities simultaneously. For those inclined to delve deeper, incorporating property features and suburb demographics into the prediction model might enhance accuracy. However, there is a natural limit of data science - if you were to tell me how much you property is worth vs how much it will actually go for in the market, I think it is sensible to expect a double digit difference. In essence, this rule of thumb is likely sufficient for screening, where broad trends are more critical than pinpoint accuracy.